The complete document is handed over to. This document contains tax information as well as information about the company and person who submits this tax information.Īfter this document has been created successfully it is extended with configuration information (proxy server, certificates, and so forth) which is needed by. Within the program all relevant data is collected and written into an XML document which follows a schema as prescribed by the Oberfinanzdirektion (OFD).

The following section describes technical aspects of submitting documents to ELSTER.

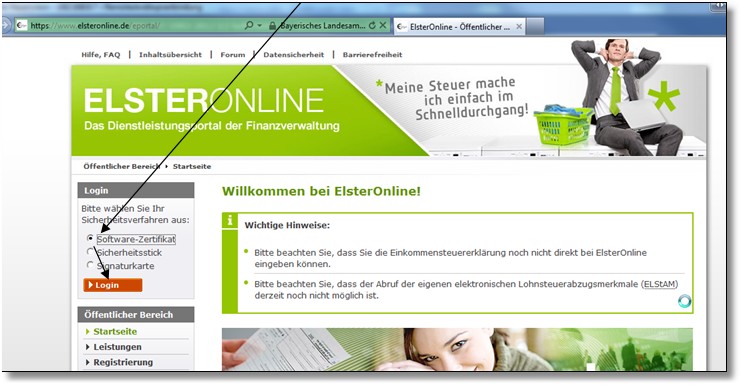

When a user submits a sales VAT advance notification from Dynamics NAV to the Elektronische Steuererklärungen (ELSTER) online portal, the assembly processes the document and then transmits it to ELSTER.

0 kommentar(er)

0 kommentar(er)